Polymarket Twin Engine

Deterministic trading infrastructure for prediction markets

Deterministic execution · Backtesting engine · Live trading infrastructure · Event-driven architecture

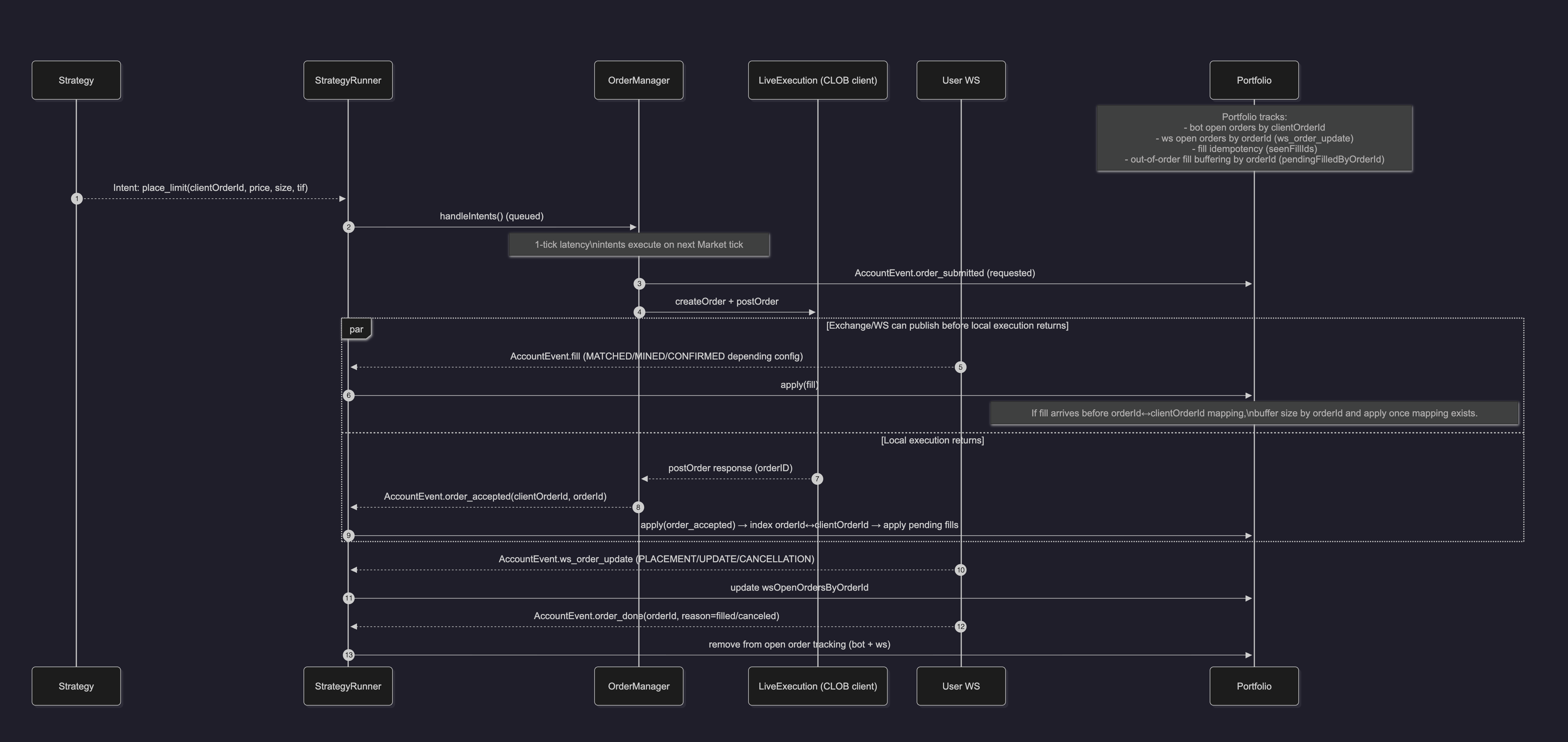

I design & built a deterministic trading and backtesting platform where live trading and simulations run the exact same strategy and execution logic, ensuring directly comparable and reliable results.

It includes full infrastructure: real-time data ingestion, order book reconstruction, execution engine, order management, portfolio accounting, and research tooling for strategy development.

Impact

- First ever backtesting system for Polymarket

- Backtest/live 99.6% parity: identical strategy + execution logic on the same tick stream

- Processes +200M market events/day through a real-time pipeline (P95 sub-100ms)

My Role

- Architected the execution pipeline and deterministic replay model

- Built ingestion + storage + replay engine (raw events → storage → reconstruction)

- Implemented order management, risk limits, and portfolio/PnL accounting